While the range of advanced recycling technologies may vary widely, one thing the conference made clear is that there are many commonalities. Among them are challenges in sourcing feedstock and gaining market acceptance as well as the potential impact of global, federal, and local packaging regulations—challenges that are not unlike those faced by traditional mechanical recycling systems.Yet, if these hurdles are overcome, advanced recycling can unleash a new and abundant supply of virgin-quality plastics made from materials previously bound for landfill or incineration. Emphasized Suzanne Shelton, president and CEO of marketing communications agency ERM Shelton Group, in her presentation on how suppliers and brands should frame the concept to consumers, “Advanced recycling is a pivotal, critical tool in the shift from a linear economy to a circular economy.”

Why is it needed?

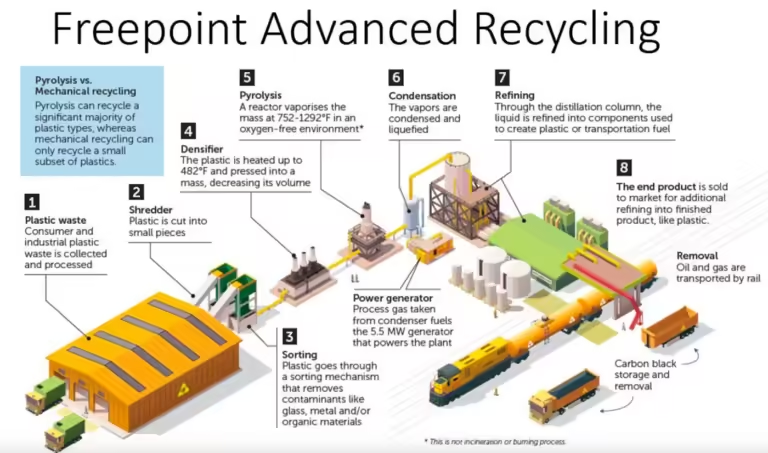

The simplest definition of advanced recycling is that it’s a process that breaks down plastic waste into its original components and uses those components to create new products. There are three categories of advanced recycling technologies—purification, depolymerization, and conversion, also known as pyrolysis (the main focus of the conference). Each one requires different inputs and results in different outputs. Feedstock for advanced recycling processes comprises plastic waste that is unable to be recycled through mechanical processes. Therefore, it complements mechanical recycling, providing another tool in the toolbox for enabling circular plastics.

As the conference presentations outlined, advanced recycling is being driven by several factors. Among them are the increase in plastic pollution; commitments made by CPG brands as part of Ellen MacArthur Foundation’s New Plastics Economy Global Commitment to reduce their use of virgin plastic materials; the growing list of states enacting EPR legislation that mandates the use of post-consumer recycled plastic content; and a growth in the global population and global wealth, which will result in more plastics in the economy.

“The demand for products that support circularity is growing, and it’s far exceeding the supply that can be met with mechanical recycling,” said Michelle Salim, NA advanced recycling commercial manager for ExxonMobil. “Society’s goal cannot be met without advanced recycling.”

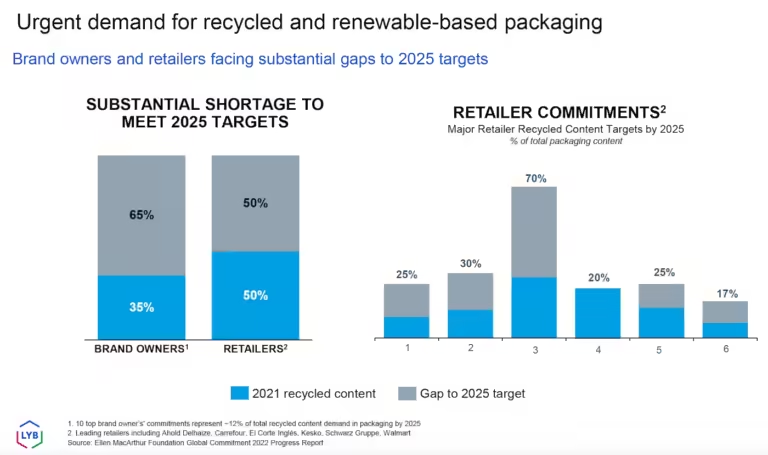

Jon Konen, senior business development manager for Advanced Recycling & Bio Feedstocks North America at LyondellBasell, put some numbers to the problem of demand versus supply. According to data from LyondellBasell, there is a 50% gap between the amount of PCR retailers need to meet their 2025 goals and what’s available; for brands, the gap is 65%. “As you go beyond 2025, we tend to see these numbers grow,” Konen added. “There’s a huge shortage for both brands and retailers in meeting their recycled content obligations and what they said they would do.”

This gap is the result of significant challenges around the collection and sorting of materials that can be mechanically recycled, along with the substantial loss of packaging materials and formats that can’t be mechanically recycled, even if the challenges with collection and sorting were solved. These latter materials are ultimately sent to landfill or incinerated. Said Konen, “We need to work on that $70 billion of value that’s lost through lack of collection and reprocessing in the industry today.”

Another roadblock for brands attempting to include more PCR in their packaging is that some mechanically recycled materials can’t be used for direct food-contact or healthcare applications due to contamination. Instead, these materials are downcycled for use in non-packaging applications such as decking and park benches.

Because advanced recycling technologies either purify waste plastic materials or break them down into their chemical components for use in creating new resins, the PCR resulting from these processes is virgin quality. Said Brendan Adams, associate director of Government Affairs for The Kraft Heinz Company, “I pulled a quote from the Closed Loop Partners’ report, and they say that advanced or molecular recycling technologies can expand the scope of materials we can recycle, help preserve the value of resources in our economy, and bridge the gap between supply and demand for high-quality recycled plastics like food-grade plastics.

“It goes on to say that it sees advanced recycling as a vehicle to satisfy food-grade recycled content needs and complex packaging structures like flexible films, thermoforms, and other types of plastics.”

Challenges with feedstock sourcing and sorting

The gap between the amount of PCR needed and the amount that’s available has created a strong business case for investment, with 50 new advanced recycling projects kicked off in 2023 alone, Konen shared. Considering current investments, the supply of PCR from advanced recycling is estimated to be 10 million tons—still short of the 15 million tons of demand, just from packaging. “We see that [gap] driving further investment and what’s needed to move the industry forward,” he added.

LyondellBasell is currently building its first large-scale advanced recycling facility in Germany, expected to produce 50,000 metric tons/yr of its Circulen Revive advanced recycled polymers by 2026.

Meanwhile, in 2022, ExxonMobil began operation of its Baytown, Tex., facility, which can produce up to 40,000 metric tons of its Exxtend advanced recycled material. It’s also constructing a second plant, with startup scheduled for 2025. “That’s part of our plan to have more than a billion pounds of processing capacity globally by 2027,” shared ExxonMobil’s Salim

Despite chemical companies’ significant investment in advanced recycling technologies, some never get off the ground due to difficulties sourcing feedstock, much of which has never been sorted or collected before.

According to Carson Potter, product leader for AMP, a provider of AI technology for waste and recycling companies, AMP’s clients often follow a similar pattern where they develop their own conversion technologies or license the technology, testing it and validating it using high-quality feedstocks. After moving from a venture to a pilot scale and then to scale up, a number of them get stuck in the finance stage, realizing they now need enough feedstock to justify their facility.

“That’s where we start to see a lot of the unanticipated challenges accumulate,” he said. “Another point is that when a company starts to drive more volume to a facility, they need to look for more profitable materials, which don’t always equate to the cleanest, most concentrated materials.”

Shared Brian Schellati, director of business development and process engineer for Van Dyk Recycling Solutions, a supplier of turnkey sorting systems to waste haulers and recyclers, “To build a large-scale commercial facility, there’s not enough perfectly clean material to justify a plant. So you have to expect the input material to be contaminated, and you have to design the mechanical processing to handle that.”

He then recommended sorting systems for advanced recycling feedstock preparation—including bale wire removers, bale liberators, elliptical/ballistic separators, conveyors, and optical sorters, etc.—noting that significant mechanical processing of materials must must be done before they are sent through optical sorters so they are fed the right way, in the right size, and without fines.

Schellati focused on the characterization of materials and using flexible, modular equipment and AI capabilities to adapt to changing feedstock. “When you combine these things, you end up with a lower-cost sensor that can essentially update over time, provide you with a number of secondary characteristics, and ideally be employed liberally throughout the plant to give you a really clean idea of what’s going into the [advanced recycling] reactor and what supply quality you’re actually receiving.”

He also explained how tracking of all materials allows a company to extricate all of the value out of the non-target feedstock as well and resell those materials as commodities—in effect using “every part of the buffalo.”

He noted that “having that kind of data-driven mentality not only allows you to manage your feedstock strategy more effectively, but it also gives you a more advanced set of capabilities in terms of getting real-time daily and weekly operational status, understanding yield, understanding purity, also understanding if things are going wrong in your plant.”

Plastic waste requires a ‘moonshot’ solution

Another speaker who emphasized the role data can play in driving advanced recycling was Rey Banatao, director, project lead for X, the Moonshot Factory, more commonly referred to as Google X. Founded by data and AI company Google, Google X is a research lab that develops and launches technologies to tackle some of the world’s most difficult problems. Driven by its chief sustainability officer, Kate Brandt, Google’s circularity mission is to maximize the reuse of finite resources across Google’s own product and operations, internally, “but most importantly, we want to enable others to do the same,” said Banatao.

Upon learning that the top sustainability search term is recycling—“over things like climate or electric vehicles or GHGs,” said Banatao—Google saw an opportunity to contribute to circularity.

“As we leaned in further, these are the three areas that were communicated back to us. First is obviously the waste industry is a data-sparse industry in our opinion compared to other areas we work in. There’s not a lot of information out there about the quality of waste, where it’s at, how to get your hands on it, and pricing, and where it ends up once it’s recycled. So the ability to identify information and follow that material through its lifecycle is important. Then we looked at the recycling technologies themselves, and that’s why we’re really interested in advanced recycling. There’s a lot of room for improvement.